Financial Freedom…How We Did It

Click bait. That’s the definition of most financial articles. Not this one. Everything I am going to tell you is on this page. So, let’s dive in. How were we, normal people, able to afford a second home? More importantly, how can YOU get your own vacation home?

First, make a goal. Okay, we’ve got that established because you are reading this. But seriously, decide to do it, and do it. How? Well, decide what it is you want. Us? We decided on a condo in Thailand. If you’ve followed our journey, and I know many of you have, you know that we are basically at a resort! Now, you have to pay for it. We paid cash, more or less. The resort allowed us to finance, interest free, for one year. $50,000 in a year may as well be cash; we paid it off in 6 months.

If you want to know more about how to get a loan for a rental property it’s best to start your research in the right places and put your best foot forward. Look for ways to use a loan creatively on the quest for freedom.

How can you do it?

First, cut out unnecessary expenses. Cable; you don’t need it and won’t miss it, I promise. Cutting the cord got the ball rolling for us and was the best thing we ever did.. That’s $150 a month (or more), saved. Sock that away. It does no good to cut expenses if you don’t earmark it. Invest that $150, or stuff it in a sock, do something to where you know that you have $150 extra every month and it is saved—not spent. This is crucial. More on that later.

That Starbucks you get every day on the way to work, $6. Twenty days a month and you’re at $120 a month. Make your own coffee, or get the free coffee at work!

Do you smoke? Stop. Not because it makes your lungs the color of my mom’s fireplace at the end of a harsh winter, not because it yellows your teeth to the shade of softened margarine, and not because it kills you, but because it is EXPENSIVE. One pack a day at seven dollars per pack, you get the picture. Another $210 you can stuff in that sock. You are gonna need a bigger sock! Cable, Starbucks, and smokes: $480. Now, we didn’t smoke. But lots of folks do, so thought I would include that.

Drink much? You still can. But who needs three, four, or five drinks EVERY time you go out to dinner? Seriously? And now you have to Uber home, because if you get a DUI you can kiss all your extra-home-savings goodbye! I am not saying stop drinking, you can go out and have a good time. You can have a glass of wine at dinner, or a beer. But enjoy it. Think before you buy. And whatever you would have spent, put in that sock or bucket or whatever. Then, pat yourself on the back, you are closer to your dream.

No more examples needed, you get the gist of it. Stop unnecessary spending. Don’t live like a hermit, have a good time, just watch it. After all, your goal is to buy another HOUSE!

Next up, your car. While Starbucks and cigarettes cause you to bleed money, a car causes severe hemorrhaging. Before the flood, yes we were survivors of Harvey, both our cars were paid for. Zero dollar car payments! I was lucky. A week before the hurricane hit, I decided to sell my car and reduce us down to one vehicle. I got $6,000 for it, and that would’ve been $0 had I waited for it to flood. Having only liability insurance would’ve killed me. My wife wasn’t so lucky. The flood waters swallowed her precious orange Charger like the whale swallowed Gepetto. Allstate gave her $12,000, which was about $3,000 more than we expected. But, now we have no car. No vehicle. We looked at several. From $10,000-$36,000. Ugh. To get anything decent we are going to have a car payment. We finally settled on a nice Nissan Murano. All the bells and whistles. $27,000. Putting twelve down, we can get buy with financing fifteen. Only about $400 a month, plus a little more on the insurance because it’s a newer car (and foreign), but it’ll be okay.

SNAP OUT OF IT! WTF ARE WE THINKING. We don’t need that! We backed out at the last minute. No papers signed.

So we don’t have a car? Of course we do. We live(d) in Texas. You HAVE to have a car. I found a 2015 Fiat in Arizona. $9500. I flew to Phoenix with $10,000 cash and drove her home. My wife, not wanting to have a car that signaled to the world that we have given up on nice things, decided to name her Fiona and throw a $300 rainbow wrap on the hood and mirrors. I’m glad we did. An unnecessary expense? Yes, but well worth it. A happy wife is a happy life!

Phew. We dodged a bullet there. Had we purchased that Murano, had we given up on our dream just because a hurricane plowed through our home and cars, we would have failed. We would be stuck in the same rut that most Americans are. Instead, we are free. FREEEEDOM! Now, we’ve identified the money leaks, so what do we do next? Remember when I said, “more about that later?” Well, it’s later, and welcome to Stash.

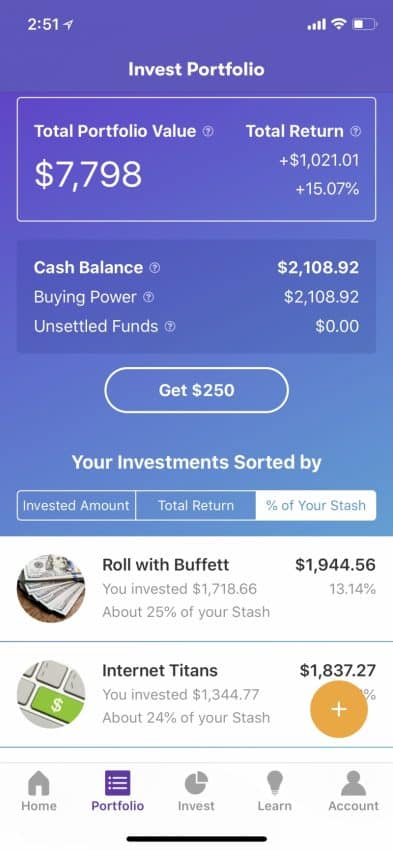

Open a Stash account. What is Stash? Stash is your sock. Stash markets itself as investing for dummies, but really they just provide the sock to stuff all your savings in. Oh, and they make it grow. Stash is an investing platform with super low fees (think $1 a month if your balance is under $5000 and just 0.25% per year if more than $5000). They provide a great mix of ETF’s and single stocks to choose from. The best part is you only need $5 to start. That’s right. You can buy $5 worth of Apple if you want. No broker or Etrade is going to let you do that! We dumped our savings into Stash, every week, via their Auto-Stash feature. By taking the money that we saved every week from having no Starbucks, no cable, no car note and socking it into Stash, we were able to turn our savings into a little more! How much more? Well, Susan starting stashing in November 2017. Today she has nearly $7800, and only invested $6800. Up $1,000 in 9 months. Every little bit helps! Think about that for a minute. In just nine months, Susan put almost $7,000 in her sock! Stash just made it grow a little. Click here to learn more about Stash and to open your own account today. Following our link gives both you and I $5 for free! What are you waiting for? (Leave us a note if you do it…we want to cheer you on and make sure you get your free money!)

Rusty, your math is off. All this doesn’t equal $50,000 in a year. Of course it doesn’t, but it put us there. It put us over the edge. Most people are always almost there. Just if they had one lucky break, they could get there. Make your own luck by doing what we did. Get rid of that unnecessary car note, cut the cord, and pour out the Starbucks. Extinguish your cigarette and have one drink instead of five. Open a Stash with all your savings and set a goal. And then, buy on our floor in Thailand, jump in the pool and enjoy life. We did!