Ditching the American Dream–Downsizing to a Bigger Life

$200,000 in debt gone, what a relief! Today our house sale is final, but what does that mean for us, and do you really care? You probably don’t, but what you do care about is yourself, and your financial well-being.

Like everyone else, we bought into the American dream. Buy the biggest, fanciest house that you can possibly afford, and whammo—you’ve won! Not so fast. Why?

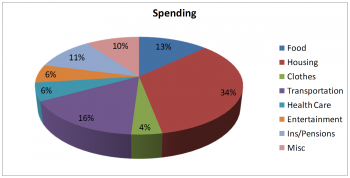

According to the Bureau of Labor Statistics, Americans spend an average of 34% of their income on housing. That is a HUGE amount of money. Talk to most financial advisors, friends, whoever, and they’ll say the same thing: you should spend about 1/3 of your income on your house. That’s rent, mortgage, whatever.

A while back, quite a while back, I wrote a post on how to save money. If you haven’t checked it out, you should. It’s quite helpful. Cutting the cord on cable, ditching Starbucks, they are all surefire ways to add to your savings and investment account. However, which is easiest? Cutting back on 20 things, or 1 thing?

Let’s pretend you are an average American. Now, we both know you aren’t. You are extraordinary, mainly because you are reading this blog, but for the sake of numbers, let’s pretend you are average. The average household makes $67,000 per year. These numbers are straight from the US Bureau of Labor and Statistics. Let’s slim it down a bit, because after all, no one pays their rent or mortgage on a per year basis. $67,000 per year is about $5,500 per month. A third of that is roughly $1,800. Are you spending $1,800 per month on housing? I’m guessing you are. Now housing includes the rent or mortgage, plus all the utilities and costs of ownership.

Do you make more or less than $67,000 per year? If so, adjust your housing number. Are you below or above average? But who says you must spend 1/3 of your money on housing? The American dream, that’s who. How big is your home? Do you really need all that space? We didn’t. We sooo didn’t, so we did something about it, we sold. But now what? We are downsizing—considerably. We are downsizing to a $0 mortgage and cutting our square footage by over 60%.

No mortgage means no interest. Interest ate our money every month. How much? I won’t conceal, I’ll reveal. This information is straight from our mortgage statement:

Principal: $352. Interest: $802. Escrow: $1,138.

Seriously?? $2,300 per month and only $350 is going to pay off the loan. How about NO. I wish I could go back in time; I would never have a mortgage. I know what you are thinking, “Who the hell can pay cash for a house?!” Well, YOU can. We are about to do just that. And if we can, you can too.

Let’s get back on topic; 33% of income going to housing. I want you to reduce that. Reduce it to 25% or less. Traveling the world has taught me something about homes in America—they are unnecessarily large. Who really needs a study? You sit at your kitchen table with your laptop and coffee anyway. And why do you have a dining room and a breakfast room?! I’m not poking fun, we did it too, but we are breaking free. Reducing from 33% to 25% is huge. If you make $70,000 a year, then you’ll go from $2,000 per month to $1500. That’s $6,000 per year saved–nearly 10% of your income.

I think Americans in general are addicted to spending money. Everything is manufactured to steal your hard-earned dollars, and it’s all designed to be easy. Nice little monthly installments. A car-note here, a mortgage there, a gym membership, insurance payments, etcetera. Enough!

Okay, so I am guessing you are not going to sell your house today. And if you rent, you aren’t moving out tomorrow to save $500 per month. But think about it. Really think about it. If you could save 25% on your biggest expense, what would you do with that extra money? Invest it and make more? Not stress about paying for vacation? Now that I’ve got you thinking, really thinking about saving money, let me throw something else at you—your car.

Let’s go back to that same Bureau of Labor Statistics. While Americans spend 1/3 on their house, they spend 1/6 on their car. Now some of that, you just can’t help. Your car needs gas, and maintenance, and insurance. The actual cost of the car itself accounts for about half, so 1/12 of your income is going to just the physical automobile. Remember, you are making $5,500 per month, so that means your car payment is $458. I bet I’m eerily close. Are you ever going to own it? Actually own it? Or are you just going to make payments and trade it in when the newer model come out?

What if you could save the money on housing, AND that $458 car payment? That would be almost $1,000 per month extra in your pocket. People keep asking me how we afford to travel all the time. This is how. We don’t have a car payment, and now, we don’t have a house payment. Two of the biggest expenses for Americans equals $0 per month for us. Well, not all the way to zero. We still pay insurance and gas for our car, and we will still have electricity and internet wherever we live. But the actual physical, tangible items, the house and the car—paid for. You can too.

Sacrifice a little to gain a lot. That’s become our motto. After all, why are you driving that 2018 Mercedes and living in the absolute most expensive place you can (barely) afford? To impress people you don’t know or don’t even like? I’ll putt around in our little Fiat, snuggle in a smaller home, and as for that extra $1000 per month? I’ll sink some into our Stash investment account, and some into savings for our next trip. Join us will you, ditch the American dream, and live the YOU dream.